Design Thinking: Emergency Preparedness

A colleague said something amazing to me a while back that I’ve been mulling over ever since:

Planning for your eventual departure is truly one of the most loving and thoughtful things you can do for your family and friends

If planning for the day when you shuffle off this mortal coil is a gift you can give to the ones who will miss you, isn’t planning for the day when you get sick or lose your job, an equally loving and thoughtful gift...for yourself?

I think it is, so today, I’m carrying on with my 2019 theme by applying design thinking to emergency-preparedness.

For those of you who haven't been with me through the whole series, design thinking is an intentional, methodical, you-focused process of creating solutions that work for your unique circumstances, values and goals, and it starts with:

Empathize

Set aside your own assumptions about the world and gain real insight into alternate perspectives.

Personal Finance 101 says that you protect yourself from risk by establishing an emergency fund and buying proper insurance, and I’m not arguing against either thing. I am, however, arguing that instead of jumping immediately to a solution, we start by fully fleshing out the problem.

The goal of this whole exercise is to be kind and thoughtful to your future self. So: who is that person? What distress are they in? Your life can be upended by a lot of things, but most can be grouped into one of two categories: losing income (think closures, layoffs, illnesses, and injuries) or gaining expenses (think big repairs, essential replacements, medical treatment or drugs your province doesn’t cover, childcare, and housekeeping).

In this first step of the design thinking process, your job is to empathize with how any permutation of these circumstances would affect you and your family. Fire up your imagination and think about:

How would your house stay clean and safe?

How would your pantry stay full (and miraculously turn its contents into meals?)

How much money would hit your bank account? In what circumstances might you be eligible for social assistance, employment insurance, or existing private or group insurance benefits like disability or critical illness?

How much money would it take to stay safe and happy?

If you have savings and would need to dip into them, how would you replace the money? If you have to borrow money, how much would you have to repay and for how long?

Who could you rely on for help?

Remember, at this stage you’re not solving anything, you’re just imagining yourself in these scenarios, What we’re looking for here are observations like:

I think I’m the only person in my house who knows how to turn ingredients into food so there’s going to have to be a lot more prepared stuff if I’m out of commission

I just moved to this town and don’t know anyone yet...and there’s no way I could get up the stairs to my apartment by myself if I broke my leg

That disability benefit looks awful low compared to what I know I need to pay the mortgage and buy groceries

If I couldn’t look at a screen for longer than ten minutes how on earth could I keep freelancing?

Paint a picture of your future self in distress. What do you need to be safe and happy?

Define

Use the information you gathered in step one to define the core problems you’ve identified.

After imagining yourself fully in catastrophe mode, you might be feeling a little nonplussed at this point. That’s good! We’re going to use the empathy you have for your future self to take really good care of her/him, I promise.

While the last stage was about identifying problems, this one is about - you guessed it - defining them. Turn your observations into defined problems, like so:

I’m the only person who can turn ingredients into food...so future, distressed me would feel better with an extra $200 a week to spend on prepared food

I don’t know anyone and can’t get up those stairs...so future, distressed me would feel better with someone or a group of someones to trust

I won’t be able to pay the mortgage and buy groceries...so future, distressed me would feel better with an extra $1,200 a month to bridge the gap left by insurance

I rely entirely on my brain + screens to earn income...so future, distressed me would feel better with disability insurance and time to figure out and implement solid, healthy workarounds

Ideate

Brainstorm solutions, without editing or limiting yourself.

You’re probably still in “Oh, sh*t. What am I going to do?” mode at this point in the process, and after two whole steps of telling you not to try and solve anything yet, here’s where you let your solution machine loose.

Throw out all the ideas, whether you think they’re realistic or not. Here, I’ll get you started:

Easy mode ideas:

Buy disability insurance

Buy critical illness insurance

Save an emergency fund

Boss mode ideas:

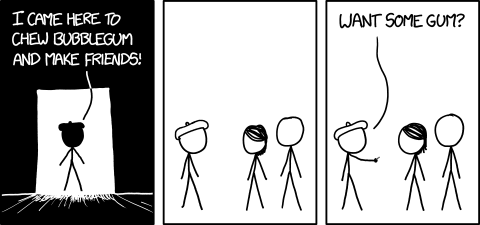

Find a community organization doing something you’re interested in, and start going (bonus points if you show up on your first day like this:

(comic credit)

Figure out exactly how much money you need to cover your essential expenses + some minimum comforts

Learn how to cook from low-cost, shelf stable ingredients (like Jack Munro teaches)

Campaign for a universal basic income (this one’s a long-term play, I grant you)

Prototype

Investigate solutions

Here’s the really practical step: can any of the solutions above work?

Find out how much all that insurance would cost. Check your group benefits at work and what your EI entitlement might be. Calculate how long it would take to save up an emergency fund. Seek out community organizations and investigate what they’re all about and what your commitment would be to them. Check out recipe books from the library and inventory your kitchen to see if cooking at home is going to cost you resources you already don’t have.

This is the point at which you might call in your friendly neighbourhood financial planner to envision how all these solutions might work together (or just to navigate the world of insurance, which isn’t something I sell but definitely something I understand).

Test

Practice those solutions.

Remember step one, when you imagined your future distressed self and tried to understand what would make her feel better? Now you’re going to pretend to be her.

Now, don’t get me wrong, I don’t want you to throw yourself down a set of stairs so you can test how your emergency-preparedness plan works...but I do want you to try and live without all of your current resources to see if it’s possible.

One of the fundamental skills that every person should have (provided that person has enough to be safe and happy already) is the ability to switch to an essentials-only budget on a dime. In a stressful situation, do you want to also be learning a system for imposing boundaries on your spending?

Answer: You do not.

So here’s a challenge for you: now that you know how much you’d receive from a disability insurance policy, for example, could you actually operate your life with only that money within the community of friends and family you already have? Try transferring the excess to a separate account for three months and see how you do (remembering, of course, that since you know this is self-imposed, the effect on your mental health and stress-levels might be very different in a live emergency).

As you observe the results, you may find new worries to add to your empathy list. You might define new problems. You might, in fact, need to go back to the drawing board. But you’ll be better prepared than you were before you started, with applied design-thinking to make it better every time you revisit it.